Quick Takes

- Risk Assets Post a Green Month. Much to market participants’ joy, risk assets rallied through the month of October, but remain deeply negative for the year.

- GDP Goes Up, Unemployment Goes Down. Despite the Fed tightening monetary policy, GDP for the third quarter of the year increased but the Unemployment Rate decreased in the US. The Fed needs to slacken the labor market in order to get wage growth under control, which should ultimately lead to getting inflation down to their target level.

- Greenback Softens Slightly. Year to date, the dollar has been on a steady grind higher, which has hurt companies that draw revenue sources from overseas and foreign central banks alike. For the month of October, the dollar spent the first half of the month climbing before stalling out into a steady decline, but ultimately finished the month higher than its lows.

- Inflation and Housing. Inflation came in above expectations yet again for the month of October, but some of this may be due to time delays in the data calculation methodologies. Housing Starts declined by more than expected, but Existing Home Sales came in above expectations.

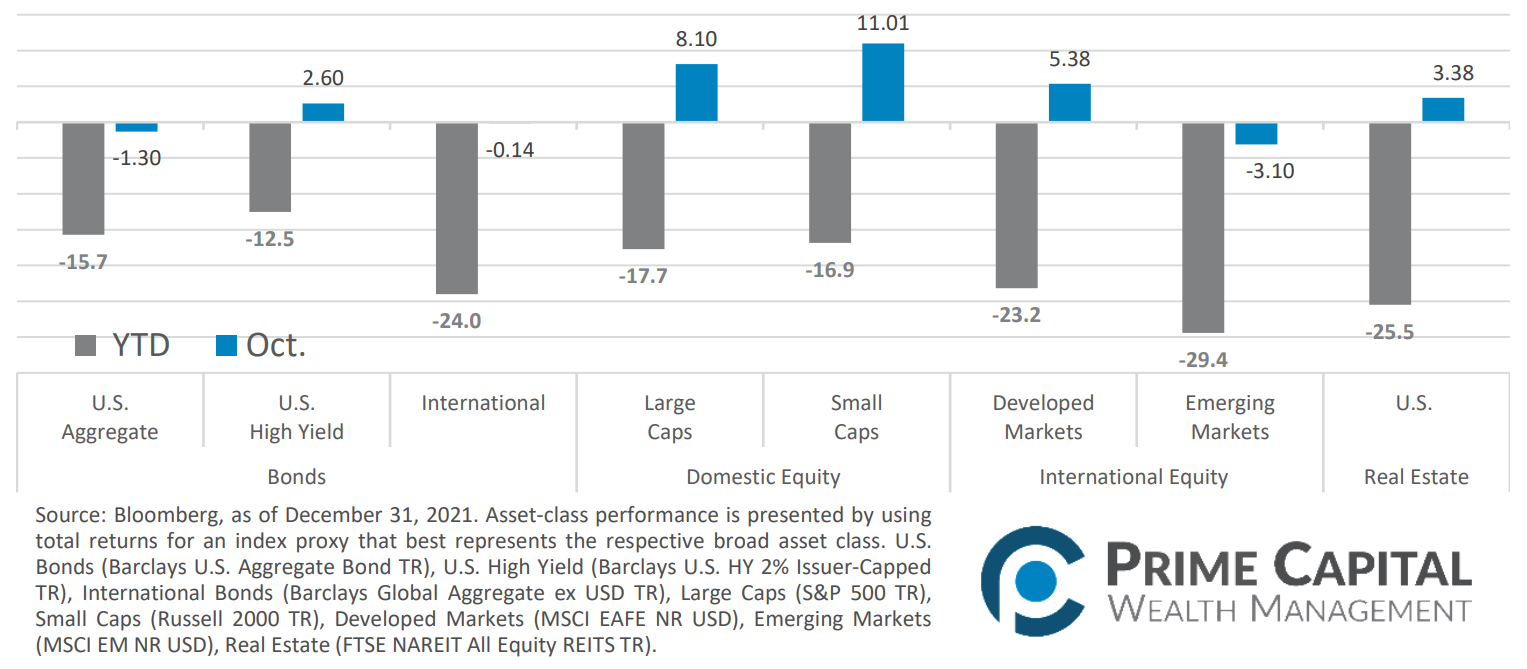

Asset Class Performance

Markets shrugged off higher than expected CPI numbers on the back of an upward surprise in US GDP growth. A majority domestic risk assets were positive for the month, while International Developed Equities were slightly negative and Emerging Markets struggled for October on the back of geopolitical concerns and tensions.

Markets & Macroeconomics

With the recent tightening of monetary policy conducted by the Fed, market participants were largely expecting to see the effects start to impact the economy and labor markets more broadly. However, both the labor market and the economy seemed to shrug off the tightening of financial conditions with the Job Openings and Labor Turnover Survey (JOLTS), a measure for how many open positions are available in the US, ticked up after decreasing the past several readings. While a low unemployment rate is typically good for an economy, the low unemployment rate combined with runaway inflation could bring about a recipe of disaster. As employers compete for laborers, they typically must increase wages to retain and attract talented workers. As consumers see these increased wages hit their bank accounts, they typically consume more goods and services. As consumers consume more, this will ultimately feedback into inflation numbers and prevent the Fed’s action from having the desired outcome, cool inflation back to a more sustainable long-term rate while at the same time preventing the US economy from entering a deep economic recession. As illustrated in the chart to the right, it appears that some of this wage pressure has worked its way through economic activity with GDP moving modestly upward after contracting for several of the previous readings. While this doesn’t bode well for future inflation readings and its potential impact on what Fed policy implications might be, it’s very likely that the way the data is calculated for these readings that this is time lag and already enacted monetary tightening, especially those actions that have been taken in the past month or two, might not fully reflect in the most recent readings. While the Fed is fully aware that time lags in the data readings exist, it’s much harder for the Fed and market participants to quantify and interpret what these time lags are. This dynamic increases the risk that the Fed will be too restrictive in their fight against inflation and might potentially send the US economy into a recessionary period. Bottom Line: Despite recent actions taken by the Fed to tame the US economy and labor markets, GDP ticked upward, and labor markets remain tight. Tight labor markets are putting upward pressure on wages, which is adding additional pressure on inflation. There is likely a time delay in the data releases and the full effects of the actions taken by the Fed thus far likely haven’t worked their way through the system, but this adds to the risk that the Fed may overtighten and send the US economy into a recession.

Bottom Line: Last month’s reading on inflation related data gave market participants false hope that inflation was beginning to show signs of moderating. Most inflation metrics released for the month of September showed that August’s inflation still increased, despite the Fed’s tightening of monetary policy. High frequency labor market data releases also hinted that the labor market remains ever tight and that the Fed’s fight against inflation is not over yet.

Download the full review.

©2022 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated.

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.

- Retirement Industry People Moves – 10/11/24 - October 17, 2024

- 4 Notable Themes from the LeafHouse National Retirement Symposium - October 16, 2024

- Month-in-Review: September 2024 - October 10, 2024