Quick Takes

● Heavyweight bout. Much of May was a battle between rising inflation fears and growing optimism from the U.S. economic recovery. Overall, though, the data points to an economy, and corporate earnings picture, that remains in an upswing.

● All’s well that ends well? There were no corrections in May, but trading was choppy. In both the second and third weeks of the month the S&P 500 traded more than ‐4% below the May 7th all‐time high, yet closed May just ‐0.7% off the record. In 11 of May’s 20 trading days, VIX was above 20 but ended at 16.8.

● Everybody’s still a winner. For the second straight month all major asset classes had positive returns, although May’s gains were more modest. Both U.S. and developed international equities are up double digits in 2021, and U.S. real estate is up +18.1%.

● Fixed income was flat. Bonds rose in May, but just barely. The best performers were Treasury‐inflation protected securities (TIPS) and investment‐grade bonds. After a rapid rise in Q1, the 10‐year Treasury yield spent April and May almost entirely in a range between 1.5% and 1.75%, closing May at 1.58%.

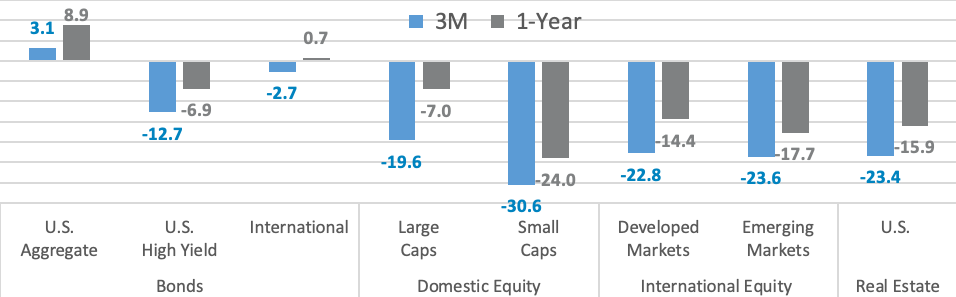

Asset Class Performance

May was defined by positive, yet modest, gains for all major asset classes. International developed and emerging market equities led in May. International bonds also finished ahead of U.S. bonds as the U.S. dollar fell further.

Vaccinations & Improving Economy Have Investors Smiling

COVID‐19 trends continue to make material improvements on virtually all fronts. The U.S. has administered over 295 million vaccines, with more than 40% of the population now fully vaccinated. The 7‐day average of new positive cases has declined to the lowest levels since the start of the pandemic and are now down ‐94% from their January highs. The 7‐day average of deaths per day is now under 400, ‐88% from their January highs. The percentage of positive COVID‐19 tests in the U.S. fell below 2% for the first time, a new pandemic low. With all the progress on the vaccination and COVID‐19 case fronts states and businesses began to fully reopen. That has resulted in a U.S. economic recovery unlike any in recent history. Consumers have trillions in extra savings and stimulus funds, banks have amassed capital, business are eager to hire and restock inventories, and new businesses are being established at the fastest pace on record. That all has investors in an optimistic mood. Rather than “Sell in May and Go Away”, investors sent the S&P 500 to new all‐time highs on May 7th while the Cboe VIX volatility index fell to 16.7, near its lowest levels since early 2020. But the remainder of May was a battle between the bulls and bears as the speed of the recovery led to bouts of inflationary scares and shortages of goods, raw materials, and workers. Private sector wages and salaries are up a staggering +19.4%in the past year and are now +5.5% above pre‐COVID levels. Consumer spending was the biggest driver of real GDP growth in Q1, including spending increases for motor vehicles and parts that increased +66.2%, durable goods that rose +48.7%, and food services and accommodations

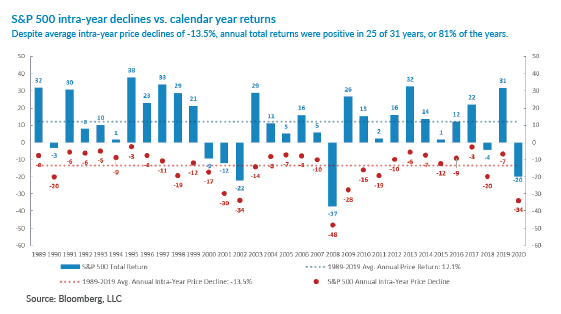

that jumped +26.6%. Gains like those, even off the extraordinarily low bases from the depths of last year’s COVID lockdowns, are bound to create inflation concerns. U.S. stocks pulled back more than ‐4% from the May 7th all‐time highs in both the second and third weeks of the month, and VIX volatility spiked to about 28 and 26 on each of those declines. But in the end the bulls took the victory as investors pushed aside the inflation fears in favor of recovery optimism. The S&P 500 rose +0.7% to post its fourth consecutive positive month, and sixth of the past seven. The small‐cap Russell 2000 index, which is more leveraged to the economic reopening, posted its eighth straight positive month for the first time since 1995.

that jumped +26.6%. Gains like those, even off the extraordinarily low bases from the depths of last year’s COVID lockdowns, are bound to create inflation concerns. U.S. stocks pulled back more than ‐4% from the May 7th all‐time highs in both the second and third weeks of the month, and VIX volatility spiked to about 28 and 26 on each of those declines. But in the end the bulls took the victory as investors pushed aside the inflation fears in favor of recovery optimism. The S&P 500 rose +0.7% to post its fourth consecutive positive month, and sixth of the past seven. The small‐cap Russell 2000 index, which is more leveraged to the economic reopening, posted its eighth straight positive month for the first time since 1995.

Importantly, vaccination rates in Europe have picked up after a relatively slow start. That has helped Eurozone economic sentiment improve for four straight months and hit its highest level since 2018.The COVID crisis in India has also made much needed progress with over 190 million vaccines so far administered–only behind the totals of US and China. As a result, those economies are also rebounding nicely. As seen in the chart above, both developed and emerging international PMIs are rising and are well into expansion levels (above 50). The MSCI EAFE Index gained +3.3% in May, outperforming U.S. stocks for the first time in 2021.

Importantly, vaccination rates in Europe have picked up after a relatively slow start. That has helped Eurozone economic sentiment improve for four straight months and hit its highest level since 2018.The COVID crisis in India has also made much needed progress with over 190 million vaccines so far administered–only behind the totals of US and China. As a result, those economies are also rebounding nicely. As seen in the chart above, both developed and emerging international PMIs are rising and are well into expansion levels (above 50). The MSCI EAFE Index gained +3.3% in May, outperforming U.S. stocks for the first time in 2021.

Bottom Line: Global equities rallied for the sixth time in seven months as vaccinations helped accelerate the recovery for most countries. Ongoing fiscal stimulus and improving earnings also boosted investor confidence.

Click here to see the full review.

—

©2021 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange‐traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐YieldBond(iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 ValueETF);MidGrowth(iSharesRussell Mid‐CapGrowthETF);MidValue (iSharesRussell Mid‐Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a

Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management

(“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2021 Prime Capital Investment Advisors, 6201 College Blvd., 7th Floor, Overland Park, KS 66211.

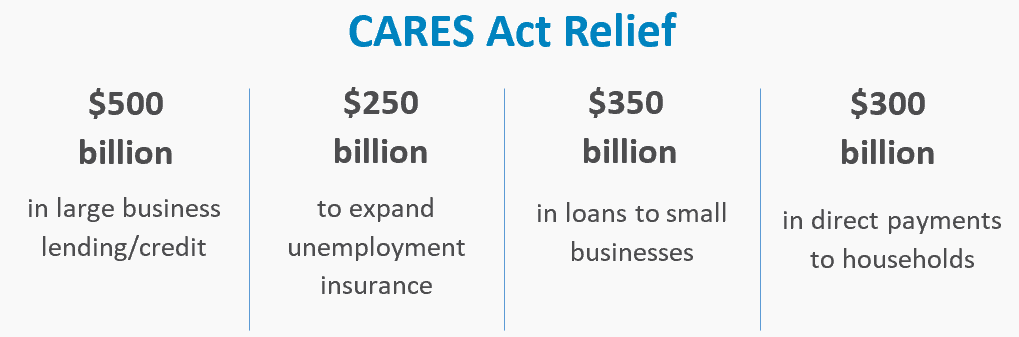

The CARES Act is intended to help consumers and displaced workers through enhanced unemployment benefits and direct payments, but also to provide a lifeline to both small and large businesses that have been impacted through largely no fault of their own. With the goal of aiding small and large businesses, in looking at the loan and grant stipulations, it appears Congress’ intentions had the individual consumer front and center. Stipulations such as maintaining minimum levels of pre-COVID-19 employment, capping executive compensation, disallowing the payment of dividends on common stock or buying back outstanding shares highlight Congress’ desire to ensure people get back on their feet, and stay on their feet. Before president Trump’s ink could even dry, politicians already started whispers of additional fiscal stimulus requirements; with some predicting the government spending reaching upwards of six trillion dollars, or roughly 27% of US GDP, to combat the fallout from the coronavirus.

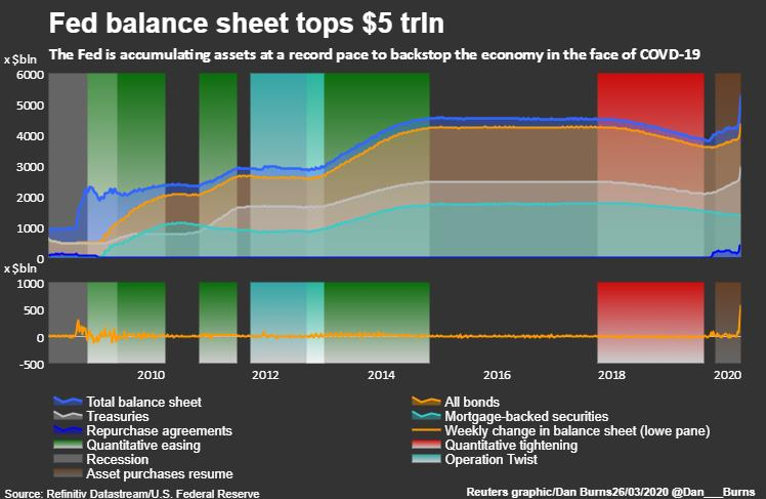

The CARES Act is intended to help consumers and displaced workers through enhanced unemployment benefits and direct payments, but also to provide a lifeline to both small and large businesses that have been impacted through largely no fault of their own. With the goal of aiding small and large businesses, in looking at the loan and grant stipulations, it appears Congress’ intentions had the individual consumer front and center. Stipulations such as maintaining minimum levels of pre-COVID-19 employment, capping executive compensation, disallowing the payment of dividends on common stock or buying back outstanding shares highlight Congress’ desire to ensure people get back on their feet, and stay on their feet. Before president Trump’s ink could even dry, politicians already started whispers of additional fiscal stimulus requirements; with some predicting the government spending reaching upwards of six trillion dollars, or roughly 27% of US GDP, to combat the fallout from the coronavirus. COVID-19. While typically more reactionary and measured in their approach, the Fed took aggressive proactive measures making their largest single rate cut of 0.50% (or 50 basis points) between scheduled Federal Open Market Committee (FOMC) meetings; the first time the Fed had taken such measures since the 2008 Financial Crisis. Less than two weeks later, again between scheduled meetings, the Fed dropped the rate on the Fed Funds effectively to zero. As the fear of the economic fallout escalated and oil continued to plummet, investors tried to sell nearly any asset containing risk; including any bond that wasn’t a treasury. While there were plenty wishing to sell, there were only a few looking to buy, creating an extraordinary dislocation across most bond categories. In order to bring back liquidity, the Fed again engaged in unprecedented measures by not only purchasing treasury securities and mortgage-backed securities, but for the first time ever, also stepping in to support municipal bonds, agency securities, and even corporate bonds through the purchase of Exchange Traded Funds – truly unprecedented. The Fed’s QE bond buying program has already seen the Fed’s balance sheet grow more than one trillion dollars; pushing their total balance sheet size above five trillion dollars. The Fed has failed to put a limit on the extent of their bond buying, leaving the amount available open-ended, but they have already purchased more in one day now than in an entire month during the Financial Crisis (80 billion).

COVID-19. While typically more reactionary and measured in their approach, the Fed took aggressive proactive measures making their largest single rate cut of 0.50% (or 50 basis points) between scheduled Federal Open Market Committee (FOMC) meetings; the first time the Fed had taken such measures since the 2008 Financial Crisis. Less than two weeks later, again between scheduled meetings, the Fed dropped the rate on the Fed Funds effectively to zero. As the fear of the economic fallout escalated and oil continued to plummet, investors tried to sell nearly any asset containing risk; including any bond that wasn’t a treasury. While there were plenty wishing to sell, there were only a few looking to buy, creating an extraordinary dislocation across most bond categories. In order to bring back liquidity, the Fed again engaged in unprecedented measures by not only purchasing treasury securities and mortgage-backed securities, but for the first time ever, also stepping in to support municipal bonds, agency securities, and even corporate bonds through the purchase of Exchange Traded Funds – truly unprecedented. The Fed’s QE bond buying program has already seen the Fed’s balance sheet grow more than one trillion dollars; pushing their total balance sheet size above five trillion dollars. The Fed has failed to put a limit on the extent of their bond buying, leaving the amount available open-ended, but they have already purchased more in one day now than in an entire month during the Financial Crisis (80 billion).