From Bull to Bear

Most importantly, please know our hearts go out to all of those impacted from the COVID-19 pandemic, especially those that have fallen ill, and those who find themselves suffering during this truly unprecedented fallout.

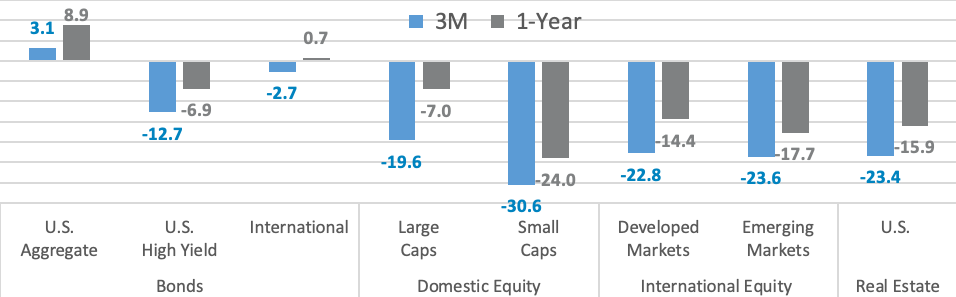

As we entered this new decade, we had done so with a cautiously optimistic outlook. The market benefited from a powerful rally at the end of 2019, driven by a “phase one” trade agreement with China, low interest rates, and a robust labor market. Analysts were forecasting a return to higher growth rates for corporate earnings, recessionary fears were fading, and stocks were reaching for all-time highs. The cautious optimism instantly eroded as the Coronavirus (COVID-19) quickly turned from a China-isolated epidemic to a global pandemic of frightening proportions. As the case count soared and containment failed, markets began to rapidly assess the economic impact that social distancing measures would have on the global economy; bringing many countries and industries to a grinding halt and impairing the global supply and demand chains. With the markets’ assessment and rapid sell-off, in what felt like a blink of an eye, the equity markets entered into a bear market, bringing our country’s longest bull market in history to an end in March. As if a global pandemic was not enough for markets to grapple with, a price war between Russia and Saudi Arabia coupled with an abrupt lack of global demand caused oil to turn in its worst quarter ever. With the market now dealing with not one, but two exogenous events, investors ran for the door, looking to sell risk assets as quickly as possible. The S&P 500 fell by as much as 34% from its highs before rallying to close the quarter off -19.60%. The Dow Jones Industrial Average officially registered its worst first quarter in history, finishing down -22.73%. Small caps fared even worse, as the Russell 2000 cratered -30.61%.

With the Coronavirus originating in China, the world’s second largest economy was forced to shut down for most of the first quarter. Unfortunately, many developed international countries were already on fragile ground and rely heavily on China for imports, causing increased strains on frail economies trying to combat COVID-19. These pressures sent the MSCI EAFE and MSCI Emerging Market indexes down -22.72 % and -23.57% in the first quarter, respectively.

During times of uncertainty, many investors sell equities and flock to the safe haven of bonds. As fears grew that the impact on global capital markets could be more severe than ever imagined, investors attempted to unload nearly any security-possessing risk. Though they mounted a comeback to close out the quarter, even investment grade corporate bonds were not safe from the storm and experienced selling pressure; with the iShares iBoxx Investment Grade Corporate Bond ETF selling off more than 3%. YTD. The only place to hide was cash or U.S. treasuries. Given the heavy allocation to U.S. treasuries in the benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index was one of a few bright spots, delivering a positive return of 3.15%

Unprecedented Market Movement

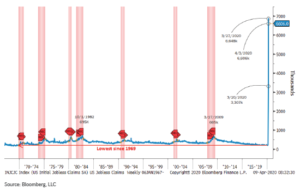

In normal times, the market may take two to three months to earn a return of 5%, yet the average daily price swings in March were almost +/- 5%. Investors witnessed the market fall more than 12% in a single day, marking the largest single day move since the 1987 Black Monday crash, only to be followed by gains greater than 11%, marking the best day since 1933. The market hit its peak on February 19, 2020, but a mere 16 trading days later, the market would fall more than 20%, officially entering a bear market in the quickest fashion. To put that pace in perspective, from 1950 to 2019, on average, a bear market took 401 days to reach.

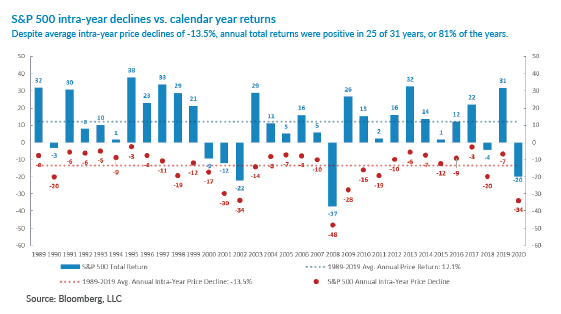

While volatility in the first quarter was truly unprecedented, markets have endured disruptions and crises in the past. Since 1989, the S&P 500 experiences average intra-year declines of -13.5% annually, and has finished the year in positive territory 81% of time; averaging a positive 12.1% per year. We’re not suggesting that 2020 will see the S&P 500 end in positive territory, but it’s simply a reminder for investors that volatility is normal and we need to try our best to control what we can – focusing on the long-term.

Unprecedented Job Loss

As mentioned above, we entered this crisis with a very robust labor market, as the unemployment rate sat at a 50-year low near 3.5%. Just as our nation’s longest bull market came to an end, as did the streak of 113 consecutive months of job growth, with unemployment jumping to 4.4%. March’s job report officially registered a loss of 701,000 jobs, but the data collected was only through the week ending March 12; before the nationwide lockdowns and social distancing mandates were enforced. Sweeping shutdowns drove unemployment claims to weekly all-time highs of more than 6.6 million in each of the past two weeks in late-March and early-April, bringing the last three-week tally to more than 16.5 million jobs lost. To put that in perspective, the highest weekly total in the 2008-2009 Financial Crisis was approximately 665,000. With these numbers only trending upward, it’s understandable why Bloomberg is projecting unemployment in April will approach 15% or higher. Hopefully, the elevated rate of unemployment will be somewhat transitory. As lockdowns are lifted and a normalcy returns, a good portion of the jobs lost will be regained. Service industries such as restaurants, retail, and hotels will rehire many, but not all, of the employees laid off. Additionally, many of the small, medium, and large businesses accepting loans under the recent government stimulus package will be required to maintain minimum employment levels. However, our economy has not endured an actual shutdown of this magnitude, so the longer-term impact on employment remains difficult to predict.

Unprecedented Government Stimulus

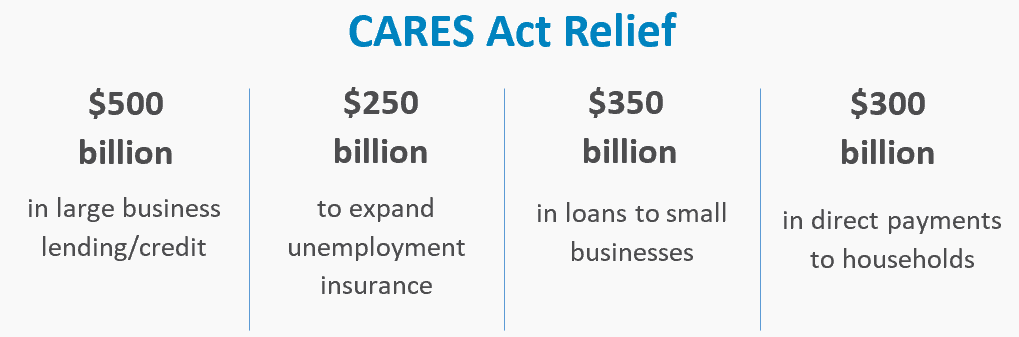

To help combat the unprecedented levels of unemployment and keep the economy afloat, the federal government passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The total size of this package exceeds two trillion dollars, which represents over 9% of U.S. annual GDP. Comparatively, the fiscal stimulus during the Financial Crisis was $800 billion, making the CARES Act 250% larger. While every day without an agreement felt like an eternity, in reality, the CARES Act was the quickest stimulus package ever to receive approval through Congress. Key provisions are highlighted in the chart below.

The CARES Act is intended to help consumers and displaced workers through enhanced unemployment benefits and direct payments, but also to provide a lifeline to both small and large businesses that have been impacted through largely no fault of their own. With the goal of aiding small and large businesses, in looking at the loan and grant stipulations, it appears Congress’ intentions had the individual consumer front and center. Stipulations such as maintaining minimum levels of pre-COVID-19 employment, capping executive compensation, disallowing the payment of dividends on common stock or buying back outstanding shares highlight Congress’ desire to ensure people get back on their feet, and stay on their feet. Before president Trump’s ink could even dry, politicians already started whispers of additional fiscal stimulus requirements; with some predicting the government spending reaching upwards of six trillion dollars, or roughly 27% of US GDP, to combat the fallout from the coronavirus.

The CARES Act is intended to help consumers and displaced workers through enhanced unemployment benefits and direct payments, but also to provide a lifeline to both small and large businesses that have been impacted through largely no fault of their own. With the goal of aiding small and large businesses, in looking at the loan and grant stipulations, it appears Congress’ intentions had the individual consumer front and center. Stipulations such as maintaining minimum levels of pre-COVID-19 employment, capping executive compensation, disallowing the payment of dividends on common stock or buying back outstanding shares highlight Congress’ desire to ensure people get back on their feet, and stay on their feet. Before president Trump’s ink could even dry, politicians already started whispers of additional fiscal stimulus requirements; with some predicting the government spending reaching upwards of six trillion dollars, or roughly 27% of US GDP, to combat the fallout from the coronavirus.

Unprecedented Monetary Stimulus

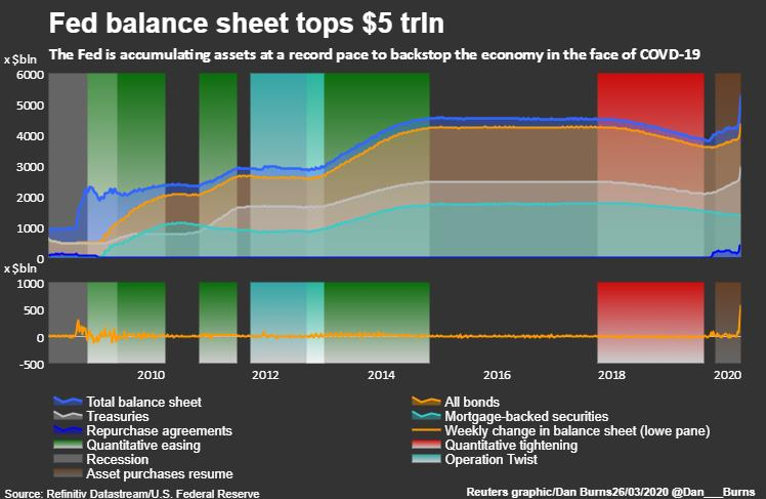

In a surprising action on March 3, the Federal Reserve was the quickest to respond to combat the economic fallout from  COVID-19. While typically more reactionary and measured in their approach, the Fed took aggressive proactive measures making their largest single rate cut of 0.50% (or 50 basis points) between scheduled Federal Open Market Committee (FOMC) meetings; the first time the Fed had taken such measures since the 2008 Financial Crisis. Less than two weeks later, again between scheduled meetings, the Fed dropped the rate on the Fed Funds effectively to zero. As the fear of the economic fallout escalated and oil continued to plummet, investors tried to sell nearly any asset containing risk; including any bond that wasn’t a treasury. While there were plenty wishing to sell, there were only a few looking to buy, creating an extraordinary dislocation across most bond categories. In order to bring back liquidity, the Fed again engaged in unprecedented measures by not only purchasing treasury securities and mortgage-backed securities, but for the first time ever, also stepping in to support municipal bonds, agency securities, and even corporate bonds through the purchase of Exchange Traded Funds – truly unprecedented. The Fed’s QE bond buying program has already seen the Fed’s balance sheet grow more than one trillion dollars; pushing their total balance sheet size above five trillion dollars. The Fed has failed to put a limit on the extent of their bond buying, leaving the amount available open-ended, but they have already purchased more in one day now than in an entire month during the Financial Crisis (80 billion).

COVID-19. While typically more reactionary and measured in their approach, the Fed took aggressive proactive measures making their largest single rate cut of 0.50% (or 50 basis points) between scheduled Federal Open Market Committee (FOMC) meetings; the first time the Fed had taken such measures since the 2008 Financial Crisis. Less than two weeks later, again between scheduled meetings, the Fed dropped the rate on the Fed Funds effectively to zero. As the fear of the economic fallout escalated and oil continued to plummet, investors tried to sell nearly any asset containing risk; including any bond that wasn’t a treasury. While there were plenty wishing to sell, there were only a few looking to buy, creating an extraordinary dislocation across most bond categories. In order to bring back liquidity, the Fed again engaged in unprecedented measures by not only purchasing treasury securities and mortgage-backed securities, but for the first time ever, also stepping in to support municipal bonds, agency securities, and even corporate bonds through the purchase of Exchange Traded Funds – truly unprecedented. The Fed’s QE bond buying program has already seen the Fed’s balance sheet grow more than one trillion dollars; pushing their total balance sheet size above five trillion dollars. The Fed has failed to put a limit on the extent of their bond buying, leaving the amount available open-ended, but they have already purchased more in one day now than in an entire month during the Financial Crisis (80 billion).

As part of the CARES Act, the Treasury Department is looking to the Federal Reserve to create the large business lending program, in which $454 billion is earmarked for the joint program between the Fed and Treasury. This is an important point because under the authorities granted to the Fed under the Federal Reserve Act, which predates the CARES Act, when the Fed declares that circumstances are unusual and exigent, and the Treasury agrees, the Fed can set up special programs that essentially buy debt from, or extend loans to, large and small businesses. Rather than the Fed simply printing the money and taking on additional credit risk, the Fed leverages the Treasury to insure against losses. Given that the Fed expects most loans to be repaid, the Treasury provides more than a dollar for dollar support, otherwise the actual lending power under the loan program would indeed be $454 billion. However, the Treasury gives the Fed a 10 to 1 ratio, giving the Fed actual lending authority up to $4.5 Trillion dollars under this loan program. Through the Fed’s bond buying program and their CARES Act lending, the Fed’s balance sheet is expected to balloon from the post Financial Crisis lows of around $3.5 trillion to just under $13 trillion. Perhaps drawing on lessons learned, the combination of the CARES Act and Federal Reserve action now dwarfs the governmental stimulus response throughout the entire Financial Crisis in 2008-2009.

Moving Forward

While the market’s focus is currently pinned to every headline surrounding the Coronavirus and/or an end to the Russia and Saudi Arabia oil price war, that focus will quickly turn to company earnings in the coming weeks. The current environment has made valuing a company extremely difficult. Many companies have already suspended providing guidance through 2020; a trend which will likely continue. Some analysts are projecting earnings contractions in line with the 40%+ contraction experienced during the Financial Crisis, along with dividend cuts greater than 20%. We wouldn’t be surprised to the see companies look to throw out the kitchen sink during the upcoming earnings releases, blaming every negative data point on the shutdown caused by COVID-19. With extremely negative results expected, we anticipate rather than focusing on whether a business beat or missed estimates, that the street will be focused on a forward-looking guidance that senior leadership provides.

Given the level of uncertainty around upcoming data, predicting the path forward for the economy is difficult. The depth and duration of the recession is more reliant on medical progress than anything else. The quicker the spread of COVID-19 can be contained, flattening the curve, the quicker the economy can begin to get back on its feet. Once stay-at-home mandates are lifted, many expect everything to snap back to normal. Our view is a bit more cautious. Unlike other nations, such as China, that may drive more of their revenue from manufacturing and exporting goods, the U.S. net imports and 68% of our economy comes from business and retail consumption. A big question remains as to how the consumer will respond once the stay-at-home restrictions are lifted. The U.S. Government has tried to help fill the void with more spending, and rumors are flying about a potentially historic infrastructure package, but to avoid a deep recession, we have to help maintain the strength and confidence of the everyday consumer, which is why we believe the CARES Act, along with additional expected stimulus, is so critical.

After 2019’s large gains across most major asset classes, we performed significant rebalances moving back to target weights in our portfolios, effectively taking some risk off the table. We also continued to emphasize quality across our portfolios, including underlying managers who have demonstrated successful track records of participating in up markets, but more importantly protecting on the downside. In March, we were able to capitalize on the lower prices by opportunistically rebalancing portfolios again, reducing bonds and increasing our equity allocations back to their intended target weights. Many segments of the market experienced significant dislocation, resulting in both temporary and permanent impairments. As such, during our rebalancing, we took the opportunity to reduce asset classes facing more lasting concerns, and increase our exposure to asset classes demonstrating stronger balance sheets, more robust earnings, and viable access to credit. When events unfold like we’re currently experiencing, it’s easy to panic. One of our responsibilities is to remove emotion from our investment decision-making process, striving not to make knee-jerk reactions. Especially, in the absence of complete data, we believe it would be imprudent to make rash or sweeping investment changes at this time. We will remain committed to a diligent process in efforts to bring our clients consistent long-term results.

Finishing as we started, please know that our hearts truly go out to all of those impacted from the COVID-19 pandemic, especially those that have fallen ill, and those who find themselves suffering during this truly unprecedented fallout. Here’s to hoping for a return to normalcy in the very near, not-so-distant future.

Click here to download the Q1 Quarterly Client Update

Chris Osmond, CFA, CFP®

Chief Investment Officer

Investment Advisory Committee

[email protected]

Eric Krause, CFA

Portfolio Manager

Investment Advisory Committee

[email protected]

—

The preceding commentaries are (1) the opinions of Chris Osmond and Eric Krause and not necessarily the opinions of PCIA, (2) are for informational purposes only, and (3) should not be construed or acted upon as individualized investment advice. Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal. Past performance is no guarantee of future results.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA: 6201 College Blvd., 7th Floor, Overland Park, KS 66211. PCIA doing business as Qualified Plan Advisors (“QPA”) and Prime Capital Wealth Management (“PCWM”).

- Alphabet stock pullback a buying opportunity - July 25, 2024

- Prime Capital Investment Advisors Welcomes James Burton as Independent Director of Advisory Board - July 15, 2024

- How Tax Planning Differs For Young Clients - July 15, 2024