Quick Takes

- Risk Assets Fall Into Autumn. Risk assets started the fall giving back some of their year-to-date gains as market participants priced in higher interest rates for longer.

- Inflation Bumps Up. Inflation, as measured by the Consumer Price Index (“CPI”), came in slightly above market estimates of +3.6%, landing at +3.7% for the month of August. Despite this hotter than expected reading, the FOMC kept rates steady, but rhetoric took on a decisively hawkish tone. This tone caused market participants to extend their forecasts for rate cuts further into the future.

- King Greenback. The dollar spent the month of September in a steady ascent on the back of the assumption that the Fed will achieve engineering a soft landing for the US economy.

- Economic Production Unrevised, Consumers Taper Spending. The final revision to US GDP for the second quarter came in below market estimations of +2.2%, coming in unchanged at +2.1%. A contributor to this miss in production estimation was Consumer Spending being revised lower from +1.7% to +0.8% for the second quarter of the year as consumers’ wallets continue to feel the pressure of inflation.

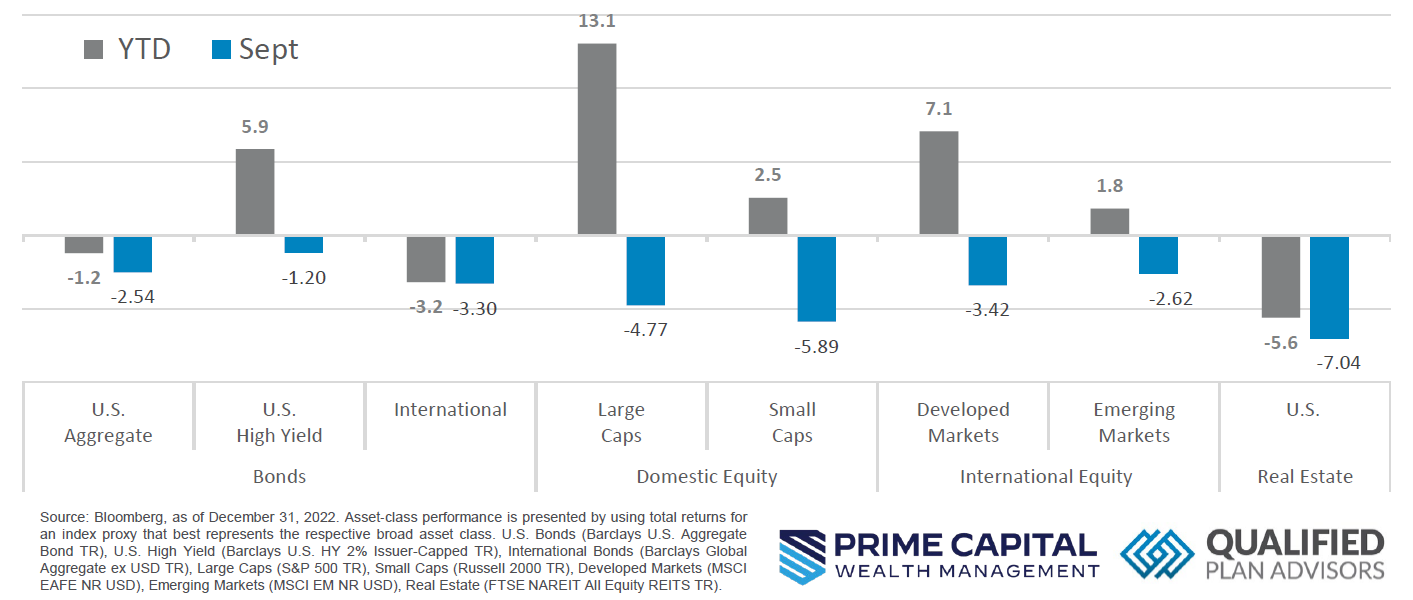

Asset Class Performance

Risk Assets cooled off with the weather as the season transitioned from Summer to Fall. Almost all major asset classes posted a decline for the month of September, many of which are now in the red for the year thus far. Domestic Large Cap equities are still clinging to a double-digit year-to-date gain after their major run-up early in year.

Markets & Macroeconomics

While inflation came in slightly hotter than expected for the month of September, it has spent the majority of the year increasing at a slower pace, i.e., disinflation. The bump in inflation reading for September was largely due to an increase in the price at gas pumps as oil advanced on the back of supply constraints around the globe. Despite the easing pressure in inflation, Consumers are feeling the pain as their wallets continue to be battered by broadly increasing prices post pandemic and subsequent government intervention. Consumers exited the pandemic with balance sheets in pristine condition, flush with government stimulus and steadily advancing wage growth. A wealthy consumer has long been thought to be the saving grace from the Fed’s unprecedented tightening in monetary conditions as they battle entrenched inflation. Consumer Spending is the main driver of the US Economy and so far, has remained resilient despite the burden of rampant inflation and tightening financial conditions. While resilient, Consumers are not immune to the effects of higher prices and interest rates, as evidenced by the revision in second quarter Consumer Spending being nearly cut in half from +1.7% to 0.8%. It appears that consumers have steadily worked their way through the stimulus provided by the government throughout the pandemic and have possibly dipped into savings or tapped lines of credit via credit cards.

With the main driver of the US economy showing signs of moderating, the soft landing scenario may be put into jeopardy. Despite this tapering in Consumer Spending, the Fed’s rhetoric made many market participants rework their base case scenarios, incorporating interest rates being at elevated levels for a longer period of time. While only time will tell if the Fed is using rhetoric to guide markets where they believe it needs to be to win the battle against inflation or if their actions will line up with their public speaking. Regardless, if consumers aren’t able to offset monetary tightening, this could have broad sweeping ramifications for the future state of the US economy.

Bottom Line: Inflation bumped up modestly for the September reading of CPI, but this was mostly due to increase in fuel prices due to tight supply in the oil markets. While this might be temporary, Consumer Spending for the second quarter was revised significantly lower, putting the revised number at +0.8% versus the original estimate of +1.7%. Additionally, recent Fed rhetoric has indicated that monetary policy loosening might be further off than market participants anticipated. Combining tighter monetary policy history with the possibility of lower consumer spending could put the scenario of a soft landing in jeopardy.

©2023 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated.

© 2023 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.

- Alphabet stock pullback a buying opportunity - July 25, 2024

- Prime Capital Investment Advisors Welcomes James Burton as Independent Director of Advisory Board - July 15, 2024

- How Tax Planning Differs For Young Clients - July 15, 2024