Volatility Re-emerges in Choppy Second Quarter

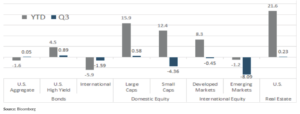

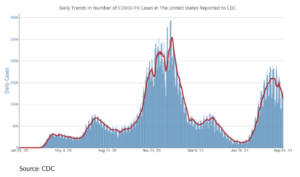

As we turn our calendars from the hot summer to temperate fall months, risk assets have started to cool with the weather, with volatility re-emerging in markets. Equities began the quarter by continuing their upward trend and breaking through record highs, driven by a dip in interest rates and robust corporate earnings reports. For the second quarter of 2021, data from Factset shows the reported year-over-year growth in earnings was 91%–the highest growth since the fourth quarter of 2009. However, after the exceptional earnings season, markets began to hesitate as the COVID Delta variant’s impact became evident on the global stage, and inflation metrics landed hotter than expected. While primarily localized to less-developed nations, Delta caused numerous shutdowns and further exacerbated already strained supply chains and global logistics within critical recovery regions. This speedbump in the return to normal eventually made its way to consumer minds as confidence in the recovery began to weaken. Federal Reserve Chairman, Jerome Powell, gave markets a verbal stimulant in his press conference after the annual Jackson Hole Symposium. Powell reiterated that asset tapering was on track to begin “soon” but quelled markets by reminding them that the taper does not mean an interest rate hike is imminent. Buyers took this in stride and pushed risk assets up toward the end of August. September held this optimism until traders began to digest the month’s economic readings. In the final days of the quarter, yield on the 10-year treasury quickly jumped to 1.567%, the highest of the quarter. This spurred traders to reduce risk and caused a sell-off within both bonds and equities. Consequently, almost all asset classes ended the month in the red. Emerging markets were hit hardest, as a situation unfolded with China’s largest property developer, coupled with a rising dollar, weighed on the broader international equity indexes. High yield bonds and large cap domestic equities were able to cling to positive territory for the quarter. While the drawdown at the end of the quarter is disheartening, most asset classes are still healthily in the green for the year.

Macroeconomic Overview

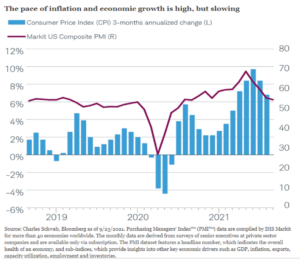

Economic data releases have transitioned from the previous quarters’ readings of explosive growth, to showing signs of moderation. Strong demand still appears to be present in the global marketplace, but regional outbreaks of the Delta variant, and subsequent shutdowns, have disrupted global supply chains, creating bottlenecks and logistical delays across regions and industries. Markit US Composite Purchasing Managers Index (PMI), a measure of overall economic activity, remains above the 50 threshold and is signaling that growth is occurring, but the readings have fallen from their peak achieved earlier in the year.

Continued demand coupled with the aforementioned supply chain woes have led to dramatic price increases over the year, and while still elevated, the pace of increase in the Consumer Price Index (CPI), a measure of inflation, has moderated over the past several months. The debate between temporary and sustained price increases will continue to be a key topic over the coming months and into next year.

With inflation at these elevated levels, market participants will shift their focus to the labor markets. Employment’s recovery has stagnated over the summer months with the Job Openings and Labor Turnover Survey (JOLTS) reaching an all-time high at the September reading of 10.9 million open positions.

The swift snapback in economic recovery in the beginning of the year has left businesses severely understaffed. In addition to posting help wanted signs, employers have been forced to compete for laborers by offering higher wages, signing bonuses, and other incentives to entice workers. Despite these incentives, the labor pool remains constrained by government unemployment assistance programs and workers still hesitant to return to COVID sensitive jobs, especially in the services and entertainment sectors.

Given that federal unemployment assistance programs have largely ended in September and Delta cases are beginning to roll over, expectations have been set for employment to increase in the coming months. However, it will take time for laborers and employers to match, thereby stabilizing employment.

The US labor market should still be on track to reach the Fed’s target of “substantial progress” toward tapering asset purchases. In recent speaking events, Fed officials have turned their tone to a more hawkish stance, indicating tighter monetary policy is right around the corner. Elevated inflation has become a much larger subject of Fed discussion, but their overall narrative remains steady that the U.S. is experiencing transitory rather than sustained inflation. Even so, the Fed has acknowledged the impact of supply chain issues and elevated prices and thus reduced their growth expectation for the year. Additionally, as economic releases have progressed throughout the quarter, Fed official’s timeline for the first interest rate hike has been moved up from early 2023, to the latter part of 2022.

of “substantial progress” toward tapering asset purchases. In recent speaking events, Fed officials have turned their tone to a more hawkish stance, indicating tighter monetary policy is right around the corner. Elevated inflation has become a much larger subject of Fed discussion, but their overall narrative remains steady that the U.S. is experiencing transitory rather than sustained inflation. Even so, the Fed has acknowledged the impact of supply chain issues and elevated prices and thus reduced their growth expectation for the year. Additionally, as economic releases have progressed throughout the quarter, Fed official’s timeline for the first interest rate hike has been moved up from early 2023, to the latter part of 2022.

While rising interest rates pose a headwind for risk assets, it’s important to recognize the longer run target of 2.50%, which can still be considered a low interest rate environment. Additionally, some form of stimulus may yet materialize as Congress debates several bills, including an infrastructure spending package. Congress remains severely divided on components of the bill, and a path to compromise remains unclear.

The rest of the Quarterly Update covers the road ahead. Read more.

—

The preceding commentaries are (1) the opinions of Brett Newell and not necessarily the opinions of PCIA, (2) are for informational purposes only, and (3) should not be construed or acted upon as individualized investment advice. Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal. Past performance is no guarantee of future results.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA: 6201 College Blvd., 7th Floor, Overland Park, KS 66211. PCIA doing business as Qualified Plan Advisors (“QPA”) and Prime Capital Wealth Management (“PCWM”).