The Bottom Line

● Global equities continued their selloff for the week as market participants digested hawkish statements from Federal Reserve officials.

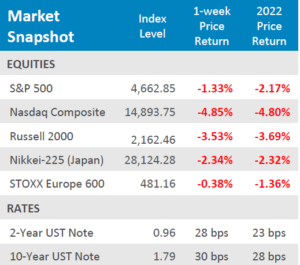

● As equities sold off, yields jumped for a second week in a row. The yield on the 10-Year US Treasury Note rose by + 30bps and the yield on the 2-Year was up +28bps for the week.

● Economic data for the week showed that labor markets stumbled with initial jobless claims rising by more than expected and inflation came in line with expectations, but reached a 39-year high, as measured by the CPI. On the other hand, prices for producers showed signs of softening with PPI rising by less than expectations.

Equities Continue Their Selloff

Global equities sold off for the week as investors priced in a combination of slowing global growth as well as a hawkish US Federal Reserve. Domestic equities spent most of the week up slightly, but after inflation readings on Wednesday and comments from Federal Reserve officials promising to “aggressively combat” rising inflation over the year, they turned deeply negative on Thursday. Most major US indices were able to eek out a positive day at the end of the week, but buyers and sellers battled throughout the day. The S&P 500 was down -1.33% for the week and Small Cap equities, as measured by the Russell 2000, were down -3.53%. The tech heavy Nasdaq Composite took on most of the selling pressure, down -4.85% for the week. International markets faired slightly better for the week but were negative overall. Japanese equities, as measured by the Nikkei-225, were down -2.34% for the week and European equities, as measured by the STOXX Europe 600, were down more modestly at -0.38% for the week. Inflation and the Fed’s future monetary policy look to be the main theme for the start of the year and may steal headlines for upcoming corporate earnings.

Digits & Did You Knows

HAS NEVER BEEN LESS –5 states (Georgia, Nebraska, Oklahoma, Utah, and West Virginia) recorded their lowest unemployment rates ever in November 2021. State jobless rates have been tracked nationwide since 1976. (source: Bureau of Labor Statistics, BTN Research).

NECESSARY SKILLS –Utah has the top financial literacy requirement for its high school students of any of the 50 US states. Utah requires all of its high school students to take a half-year course dedicated to personal finance, and then to take a final exam administered by the state. Ohio is the latest US state to add some form of financial literacy instruction at the high school level, effective 01/27/2022. (source: Champlain College Inc. , BTN Research).

Click here to see the full review.

—

Source: Bloomberg. Asset-class performance is presented by using market returns from an exchange-traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High-Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 31% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.

- Month-in-Review: April 2022 - May 5, 2022

- Month-in-Review: March 2022 - April 5, 2022

- Week-in-Review: Week ending in 03.25.22 - March 28, 2022