The Bottom Line

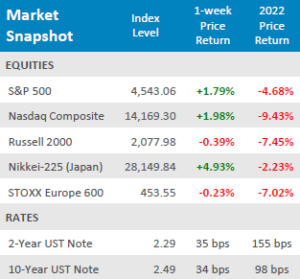

● Risk Assets continued to dig themselves out of their year-to-date hole, with most global indices posting a positive, or very slight negative week.

● Bond yields continued their climb higher, the yield on the

2- Year rose 35bps and the 10-Year was just behind it, climbing 34bps.

● Economic data releases were on the softer side and mainly focused on regional manufacturing data and real estate activity, which showed that buyers are being priced out of the market from high home prices and a climbing mortgage rate. Next week is jampacked with economic releases as the quarter comes to an end.

Markets Grind Higher

While the conflict between Russia and Ukraine remains at the back of market participants minds, domestic equities were able to post a solid week mostly in the green, albeit on low overall volume, which may indicate a lack of conviction in the market’s steady upward trajectory over the past two weeks. The S&P 500 gained +1.79% for the week, now only down -4.68% for the year so far. The tech-heavy Nasdaq was able to best the S&P 500, climbing +1.98% for the week, but remains deeply in the red for the year at -9.43%. Small Cap equities, as measured by the Russell 2000 couldn’t go positive for the week, falling -0.39% for the week. Japanese equities, as measured by the Nikkei-225 posted a robust week, climbing +4.93% for the week, but this wasn’t enough to bring it positive for the year, the index is down -2.23% for 2022. European equities also fell for the week, down -0.23% despite news hitting the wire that the US and EU came to an agreement on liquid natural gas shipments as the EU fights to become less dependent on Russian energy export due to their invasion of Ukraine. Looking ahead, market participants will be eagerly awaiting US GDP data and employment data releases slated for the end of next week.

Digits & Did You Knows

WATER NEEDED – 74% of the land in the western United States (covering 9 states) is in a “severe drought” as of last Thursday 3/17/2022. (source: US Drought Monitor, BTN Research)

LEGAL OR NOT? – 18 US states have legalized the recreational use and sale of marijuana, although the use and sale of marijuana remains illegal at the federal level. (source: US News & World Report, BTN Research)

MID-POINT– 49% of the 157.8 million Form 1040s that were filed for tax year 2019 (a total of 77.9 million returns) reported less than $40,000 of adjusted gross income (source: IRS, BTN Research

Click here to see the full review.

Source: Bloomberg. Asset-class performance is presented by using market returns from an exchange-traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High-Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 31% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.

- Month-in-Review: April 2022 - May 5, 2022

- Month-in-Review: March 2022 - April 5, 2022

- Week-in-Review: Week ending in 03.25.22 - March 28, 2022