The Bottom Line

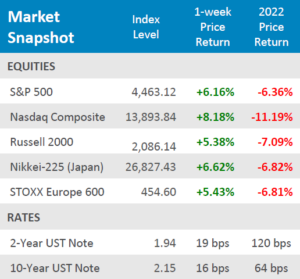

● Risk Assets were able to rise out of their recent slump and posted a positive week almost across the board.

● Bond yields rose for the week, with the 2-Year yield jumping +19bps for the week and the yield on the 10-year rising +15bps for the week.

● Overall, economic data releases mostly met their expectations, showing that despite the near-term effects of the Russia-Ukraine conflict, the economy is still marching on. Importantly, the FOMC raised interest rates for the first time and took on a very hawkish tone for future monetary policy. Next week is on the lighter side, most releases relate to manufacturing data and real estate.

Markets Cheer On Interest Rate Liftoff

While the conflict between Russia and Ukraine continues to keep market participants on their toes, traders shifted their focus back home as the FOMC initiated interest rate liftoff by raising the Fed Funds Rate by +25bps. While this was widely anticipated, there were murmurs of a possible +50bps hike. Overall, markets took this in stride and were able to post a positive week across the board. The S&P 500 was able to jump up +6.16% for the week, which nearly cut its year-to-date loss in half. Domestic small cap equities, as measured by the Russell 2000, were not too far behind the large caps, the index was up +5.38% for the week. Japanese equities, as measured by the Nikkei-225, rallied with domestic equities, rising +6.62% for the week. European equities weren’t left behind on the week either, the STOXX Europe 600 was able to post a solid +5.43% gain for the week. The tech-heavy Nasdaq Composite was the winner for the week, jumping a whopping +8.18% for the week, but still in the red on the year-to-date return by -11.19%. Looking to the week ahead, market participants will still by swayed by headlines surrounding the Russia-Ukraine conflict, as well as the myriad of manufacturing and real estate releases for next week.

Digits & Did You Knows

SINCE THEN – President Donald Trump declared the coronavirus pandemic a “national emergency” on Friday 3/13/2020. Over the 2-years since then, i.e., Monday 3/16/2020 through Friday

3/11/2022, the S&P 500 gained +60.0% (total return), in spite of a -12.0% loss (total return) on Monday 3/16/2020. (source: BTN Research).

MAXED OUT – 0nly 8.5% of workers who have access to an employer-sponsored defined contribution plan, e.g., 401(k) plan, contribute the maximum amount permitted by law. (source: Congressional Research Service, BTN Research).

EDUCATION – 62% of American adults have received education beyond high school, including adults with some college credits all the way to those adults who have earned a doctoral degree.

(source: Census Bureau, BTN Research).

Click here to see the full review.

Source: Bloomberg. Asset-class performance is presented by using market returns from an exchange-traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High-Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 31% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.

- Month-in-Review: April 2022 - May 5, 2022

- Month-in-Review: March 2022 - April 5, 2022

- Week-in-Review: Week ending in 03.25.22 - March 28, 2022