Quick Takes

● Markets Loose Footing as Fed Turns Hawkish. With the Fed promising to take aggressive action against rising inflation, market participants spent the month of January in risk off mode, sending all asset classes into the red for the first month of 2022.

● Short-Term Yields and Long-Term Yields Jump. With the Fed’s hawkish stance, yields, both on the 2-Year UST Note and the 10-Year UST Note, skyrocketed as investors priced in a more aggressive monetary tightening process for the year. The first rate hike is now expected to occur in March.

● Greenback Strengthens in January. Consistent with a more hawkish Fed, the Dollar strengthened for the first month of the year, but finished the month at 96.54, which was below its high of 97.27.

● Supply chains, Labor Markets, and Inflation. Employment spent most of the month softening, this was likely a delayed effect due to the rapid spread of the omicron variant. Inflation, as measured by the Consumer Price Index (CPI) hit its highest level since the 1980s at the January data release and supply chains remained constrained overall. Despite these headwinds, GDP for 2021 posted its strongest advance since the 1980s.

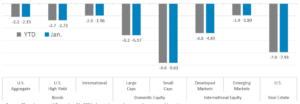

Asset Class Performance

Markets finished the first month of the new year by posting their worst month since March of 2020, or since the start of the global pandemic. Domestic equities led the way down, and while still negative, Bonds, International Equities, and even Emerging Markets were down significantly less than US equities.

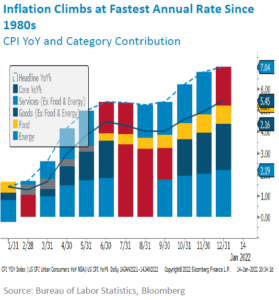

Fed Promises Aggressive Action Against Accelerating Inflation

After Jerome Powell was confirmed for a second term as Chairman of the FOMC and several rotations of regional Presidents becoming voting members, the narrative surrounding the Fed’s outlook on future monetary policy actions turned decidedly hawkish. Many members vowed to take aggressive actions in combatting rising inflation. For the January inflation reading, inflation, as measured by the CPI, accelerated at its fastest pace since the 1980s, coming in at+7.0% on an annualized basis. Continued accelerating inflation, combined with robust economic growth, as

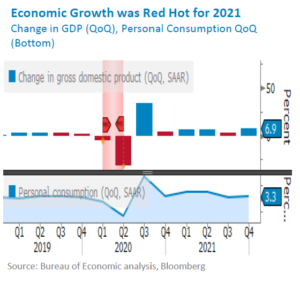

measured by the change in GDP (right), and tight labor markets, led the FOMC to an acceleration of their tapering process and has opened the door to a sooner than expected liftoff in interest rates. Previously, market participants were expecting the first increase in interest rates to occur in late 2022 or possibly early 2023, after the Fed’s shift to a hawkish stance, market participants are now expecting the first increase to occur in March of 2022 and are now expecting multiple rate hikes to occur during this year. Tighter monetary policy typically leads to slowing economic growth, which was the main catalyst for traders shifting into risk off mode for the first month of the year.

While consumers are still well positioned after the unprecedented amount of stimulus distributed by the government during the global pandemic, the expectation of slowing economic growth seems to be weighing on consumption habits. As seen in the chart above, personal consumption flatlined for the final months of the year, possibly signaling that consumers are delaying current spending due to the expectation of increased costs in the future. Additionally, the rapid spread of the omicron variant may have impacted some spending habits and leisure activities during the holiday season. It’s possibly the consumption may swing upwards as omicron cases rollover.

While consumers are still well positioned after the unprecedented amount of stimulus distributed by the government during the global pandemic, the expectation of slowing economic growth seems to be weighing on consumption habits. As seen in the chart above, personal consumption flatlined for the final months of the year, possibly signaling that consumers are delaying current spending due to the expectation of increased costs in the future. Additionally, the rapid spread of the omicron variant may have impacted some spending habits and leisure activities during the holiday season. It’s possibly the consumption may swing upwards as omicron cases rollover.

Bottom Line: The Fed’s shift to a hawkish stance and promises to aggressively fight inflation led market participants to quickly pivot into risk off mode for the month of January as they priced in a sooner than expected liftoff and frequency in interest rate hikes. This led to all major asset classes posting a negative month for the first month of 2022. This flight to safety and expectation of tighter monetary policy, and thus slowing future economic growth, overshadowed robust economic growth in the final quarter of 2021.

Click here to see the full review.

©2022 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange‐traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐YieldBond(iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 ValueETF);MidGrowth(iSharesRussell Mid‐CapGrowthETF);MidValue (iSharesRussell Mid‐Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.

- Month-in-Review: April 2022 - May 5, 2022

- Month-in-Review: March 2022 - April 5, 2022

- Week-in-Review: Week ending in 03.25.22 - March 28, 2022