Quick Takes

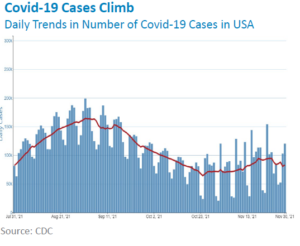

● Covid Resurgence. Equities, especially international, plummeted for the month of September as the delta variant continued to work its way through populations and a new variant threatens the globe.

● Yields fall as fears rise. With delta cases rising across the globe and the new variant threatening the economic progress made thus far, yields tumbled at the end of the month and spreads between investment grade and high yield bonds widened as traders searched for protection from the selloff in equities.

● Greenback Climbs But Retreats From Highs. The dollar spent most of the month in a steady upward trajectory right up until the Thanksgiving holiday. With global Covid cases climbing and yields ticking lower, the dollar spent the last few days of the month in a descent, but still ended above where it started the month.

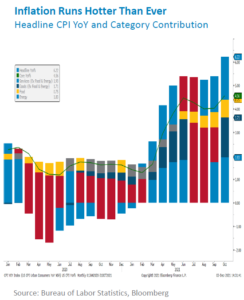

● Supply chains, Labor Markets, and Inflation. Supply chains and labor markets hinted ever so slightly at showing signs of improving, inflation however, continues to run hotter than expected. The Fed started tapering its asset purchases to help reign inflation in at the end of the month.

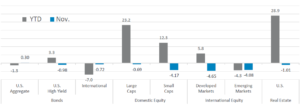

Asset Class Performance

Risk assets were in the red across the board for the month of November. Domestic bonds were the only positive asset class for the month, up slightly at +0.30% as investors searched for a safe haven.

Covid and Inflation Move Upward, Markets Move Downward

November initially started where October left off, with equities continuing their grind higher. Midway through the month, inflation, as measured by the CPI, came in at an astounding +6.22% on a year-over-year basis. Even when removing the ever-volatile food and energy components of CPI, Core CPI surpassed its recent summer high of 4.47%, landing at 4.56%. With inflation running at a breakneck pace this year, the Fed finally announced that it will begin tapering its asset purchases. This is the next step in removing government stimulus from the markets but is planned to be scaled back over several months to allow markets to absorb the shock. However, with inflation as high as it is and showing no signs of abating, the Fed maybe forced to accelerate its timeline to ensure the economy doesn’t overheat. Higher frequency data on supply chains started to show some initial signs of easing, which should also help to reign in inflation over time, but it will still take a significant amount time for supply and demand to match up.

Initially, labor markets showed some modest signs of improvement at the beginning of the month with the unemployment rate falling to 4.6%, but higher frequency data releases throughout the month gave off more mixed signals. Posing as a risk to employment and growth alike, delta variant cases started to increase as the month continued, not just in the United States, but also abroad. As if that weren’t a big enough concern, near the Thanksgiving holiday a new variant was discovered in South Africa. The CDC later assigned the Greek letter omicron to this new variant. It’s still early in the life of the variant and more information is expected to be released during the first part of December. Depending on how contagious and severe this new variant is, omicron could represent a significant headwind to labor markets and thus the broader economic recovery and continued growth.

Initially, labor markets showed some modest signs of improvement at the beginning of the month with the unemployment rate falling to 4.6%, but higher frequency data releases throughout the month gave off more mixed signals. Posing as a risk to employment and growth alike, delta variant cases started to increase as the month continued, not just in the United States, but also abroad. As if that weren’t a big enough concern, near the Thanksgiving holiday a new variant was discovered in South Africa. The CDC later assigned the Greek letter omicron to this new variant. It’s still early in the life of the variant and more information is expected to be released during the first part of December. Depending on how contagious and severe this new variant is, omicron could represent a significant headwind to labor markets and thus the broader economic recovery and continued growth.

With the Fed tightening monetary policy and Covid cases beginning to show signs of increasing over the colder winter months, combined with a new variant, the path forward for risk assets appears to be uncertain, but will likely be volatile going into the new year.

Bottom Line: Equities retreated from their highs after inflation continued to run beyond expectations and Covid cases flipped their trajectory into an upward tilt as the winter weather started hitting. The Fed initiated the tapering of asset purchases to attempt to reign in inflation.

Click here to see the full review.

—

©2021 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange‐traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐YieldBond(iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 ValueETF);MidGrowth(iSharesRussell Mid‐CapGrowthETF);MidValue (iSharesRussell Mid‐Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2021 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.

- Month-in-Review: April 2022 - May 5, 2022

- Month-in-Review: March 2022 - April 5, 2022

- Week-in-Review: Week ending in 03.25.22 - March 28, 2022