The Bottom Line

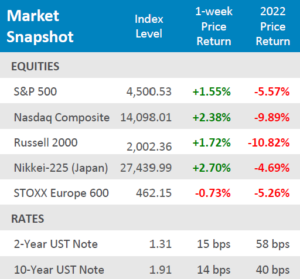

● US Markets recovered some of their losses sustained at the beginning of the year this week but remain in the red year to date.

● Yields rose yet again for the week, the yield on the 2-Year US Treasury note rose +15bps and the yield on the 10-Year US Treasury note was up +14bps for the week.

● Economic data for the week showed that the labor markets shrugged off impacts from the rapid spread of the omicron variant and are running as red hot as inflation. Manufacturing data came in somewhat mixed for the month of January. Next week will be a light week for economic releases, but market participants will be eagerly awaiting updated inflation data with the CPI data release.

Markets Regain Some Ground

Posting a strong start for the month of February, US markets chipped away at some of their year-to-date losses achieved in January. The S&P 500 rose by +1.55% for the week and Small Cap equities, as measured by the Russell 2000, were even better, up +1.72% for the week. After a bloody month of January for the tech-heavy Nasdaq Composite, the index was able to climb a whopping +2.38% for the week but is still off almost 11% thus far for the year. Japanese equities, as measured by the Nikkei-225, bested the Nasdaq for the week, rising +2.70% and only down -4.69% for the year so far. European equities, as measured by the STOXX Europe 600, was the only index not in the green for the week, down -0.73% this week and -5.26% for the year. US companies are currently in the middle of earnings season, with around 56%of S&P 500 companies having reported fourth quarter results for last year according to Factset. Of these companies that have reported, 76% have reported actual earnings per share above consensus estimates, which is equal to the five-year average, also according to FactSet.

Digits & Did You Knows

FED JOBS – President Biden nominated 3 individuals – Sarah Bloom Raskin, Lisa Cook, and Philip Jefferson – on Friday

01/14/2022 to fill vacant positions on the Fed’s 7-member Board of Governors. (source: White House, BTN Research).

CARS IN DEMAND – The price of “new vehicles” increased

++11.8% in 2021, dwarfed by the +37.3% increase in the price of “used cars and trucks” last year. (source: Bureau of Labor Statistics, BTN Research).

THE AVERAGE AMERICAN WORKER– US private sector workers earned an average of $31.31 per hour as of December 2021. (source: Bureau of Labor Statistics, BTN Research).

Click here to see the full review.

—

Source: Bloomberg. Asset-class performance is presented by using market returns from an exchange-traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High-Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 31% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.

- Month-in-Review: April 2022 - May 5, 2022

- Month-in-Review: March 2022 - April 5, 2022

- Week-in-Review: Week ending in 03.25.22 - March 28, 2022