The Bottom Line

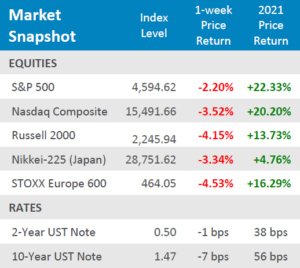

● Global risk assets tumbled for the week as the threat of a new covid-19 variant rises.

● Yields fell with stocks as investors looked for havens, the 2- year treasury yield fell -1bps, and the 10-year yield plummeted -7bps.

● Economic releases for the week were compressed to the first half of the week with the markets being closed on Thursday and only open for a morning session on Friday due to the Thanksgiving holiday. Factory activity showed signs of increasing, but service activity softened. Personal Consumption and Personal Spending for the previous quarter came in hotter than expected.

Covid Variant Threat Rises, Markets Fall

Global markets have had back-to-back weeks of covid threatening to hinder the progress of global economic recoveries. Last week, delta variant cases began to spike, especially in European nations, now this week, a new variant has shown threats arising from South Africa. Fears of economies returning to shutdowns spooked traders, turning buyers into sellers across global markets. European equities were hit hard, falling -4.53% for the week after already showing signs of stress from the delta variant. Japanese equities, as measured by the Nikkei-225, fell -3.34% for the week. Volatile small cap US equities were right behind European equities, falling -4.15% for the week. Nasdaq equities weren’t immune to the selloff, despite the “stay-at-home” and biotech constituents within the index, falling -3.52% for the week. The S&P 500 was able to fair slightly better but was still significantly in the red for the week, falling -2.20%. Treasury yields fell with equities as investors searched for haven assets, the 2-year US Treasury Note yield fell by -1bps and the 10-year US Treasury Note yield fell by a whopping -7bps for the week. Risk assets could have a volatile finish to the year as traders begin to price in the new variant’s impact on global economies.

Digits & Did You Knows

WHEN THE FED LAST RAISED RATES – Between 12/14/16 and 12/19/18, the Fed raised short-term interest rates 8 times

(0.25% points each time). Between 12/14/16 and 12/19/18, the S&P 500 increased +15.8% (total return) in aggregate over the 2-years. (source: BTN Research).

AT LEAST A FEW DAYS AT HOME – 25% of 2,050 full-time workers surveyed in September 2021 say they would quit their job if their employer completely eliminated the “work-from-home” option in a post-pandemic world. (source: 2021 State of Remote Work, BTN Research).

SLOW MOVING – Ships carrying containers traveling from China to the United States travel at a speed of 16-18 mph. (source: Freightos, BTN Research).

Click here to see the full review.

—

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange‐traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐YieldBond(iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 ValueETF);MidGrowth(iSharesRussell Mid‐CapGrowthETF);MidValue (iSharesRussell Mid‐Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2021 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.

- Month-in-Review: April 2022 - May 5, 2022

- Month-in-Review: March 2022 - April 5, 2022

- Week-in-Review: Week ending in 03.25.22 - March 28, 2022