The Bottom Line

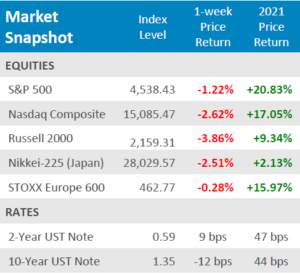

● Equities posted a second week of losses after the CDC announced the first omicron case and employment data disappointed.

● Yields were volatile for the week, with the yield on the 2-year rising +9bps and the yield on the 10-year plummeting -12bps.

● Economic data for the week painted a murky picture with Pending Home Sales roaring upward, Construction Spending missing estimates, and a curious case of job growth being the smallest of the year, but the unemployment rate fell to a pandemic low and labor force participation edged higher.

Covid Variant Spook Traders

The start to the final month of the year was rough for financial markets across the globe as traders began to price in the impact of the existing delta variant, as well as the new omicron variant. Several European economies announced a return to lockdowns and the CDC announced the first US omicron case was discovered in California on Wednesday. With the lockdowns resuming overseas, European equities were dragged down into negative territory for the week, the STOXX Europe 600 fell -0.28%. The world’s third largest economy, Japan, was hit even harder with the Nikkei-225 falling -2.51% for the week. Domestic equities weren’t immune to the selloff either, the S&P 500 fell -1.22% for the week and the Nasdaq was even worse, falling -2.62%. Small Cap equities, as measured by the Russell 2000, were hit the worst, falling -3.86% for the week. Fed Chairman Powell took on a hawkish tone as he testified in front of Congress, alluding to a possible accelerated timeline to tightening monetary policy and thus opening the door to a sooner than expected increase in interest rates. Looking ahead, market participants will be eagerly awaiting data studies on the new covid-19 variant, which are scheduled to be released at the end of next week.

Digits & Did You Knows

NICE NEIGHBERHOOD – The costliest zip code in the USA is 94027 (Atherton, CA.) where the median sales price of a single-family home in 2021 was $7.475 million. (source: Architectural Digest, BTN Research).

HUGE BUT SLOWING DOWN – Student loan debt nationwide was $1.58 trillion as of 09/30/21, but the total has increased just +1.9% over the last 12 months. Over the last 5 years, student loan debt has increased +23.5% (from $1.279 trillion to $1.580 trillion), an average increase of +4.3% per year. (source: Federal Reserve Bank of New York, BTN Research).

A WORLD RECORD – Diane Friedman ran 100 meters in 36.71 seconds on 08/15/21 at the Michigan Senior Olympics, the fastest 100 meters ever run by a woman at least age 100.

(source: GrowingBolder.com, BTN Research).

Click here to see the full review.

—

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange‐traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐YieldBond(iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 ValueETF);MidGrowth(iSharesRussell Mid‐CapGrowthETF);MidValue (iSharesRussell Mid‐Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2021 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.

- Month-in-Review: April 2022 - May 5, 2022

- Month-in-Review: March 2022 - April 5, 2022

- Week-in-Review: Week ending in 03.25.22 - March 28, 2022