With the tax filing deadline around the corner, many individuals might be wondering what they are going to spend their refund on. A more important question might be, “How much can I save?” With the COVID-19 pandemic continuing on, many companies have had to lay off or furlough employees with countless more experiencing reduced hours. While it might seem like a good time to splurge, we learned in 2020 that you can never be too prepared for the future.

As you’re preparing for your potential refund or if you’ve already received it, here are a few items you should also be evaluating:

- Nonessential recurring expenses: Write a list of all nonessentials and decide which ones are important enough for you to keep and which items you can cancel. You can also see if you can pay off the ones that you want to keep. If you want to keep that gym membership see if you can pay for the entire year and potentially get a better deal!

- Credit card balances: Look at what credit cards have the lowest balances and see if there is an opportunity to get some paid off with your refund.

- Student loan payments: Do you have lingering student loans? Take a look at what you owe and plan to use your refund to make a dent in your debt.

- Restrict online shopping: Unsubscribe from all retail emails, don’t save your card information online, and delete shopping apps off your phone to make it harder for yourself to shop online.

- Prep for grocery shopping: Before you go shopping or place your delivery order, set aside a little time to create a grocery list. Not only will it help you stay on track to purchase only what you need, but it’ll also stop you from eating out as much.

The most important step is to have a plan. As soon as you know if you will be getting a refund, you should decide what to do with it. Setting time aside to prepare and plan will ultimately pay off in the long run. For help with determining how much you need to set aside in savings and how to build up that account, reach out to our advisors at https://pciawealth.com/contact-us/.

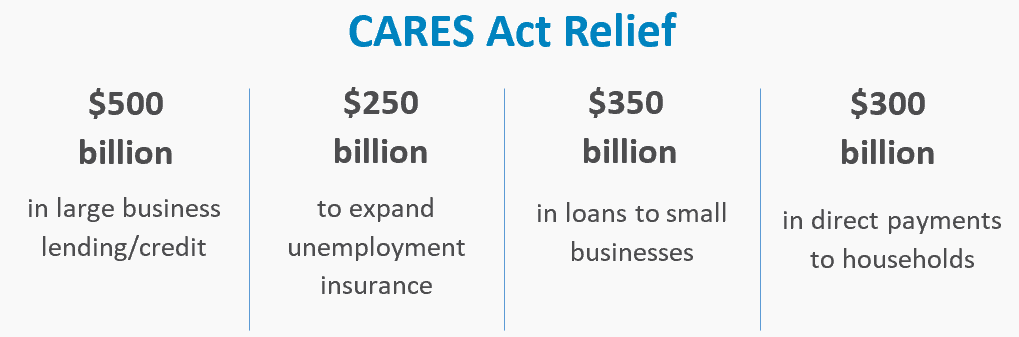

The CARES Act is intended to help consumers and displaced workers through enhanced unemployment benefits and direct payments, but also to provide a lifeline to both small and large businesses that have been impacted through largely no fault of their own. With the goal of aiding small and large businesses, in looking at the loan and grant stipulations, it appears Congress’ intentions had the individual consumer front and center. Stipulations such as maintaining minimum levels of pre-COVID-19 employment, capping executive compensation, disallowing the payment of dividends on common stock or buying back outstanding shares highlight Congress’ desire to ensure people get back on their feet, and stay on their feet. Before president Trump’s ink could even dry, politicians already started whispers of additional fiscal stimulus requirements; with some predicting the government spending reaching upwards of six trillion dollars, or roughly 27% of US GDP, to combat the fallout from the coronavirus.

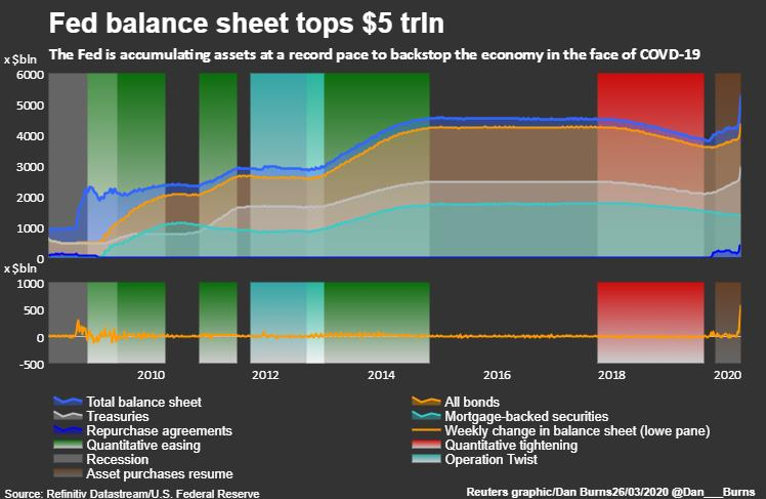

The CARES Act is intended to help consumers and displaced workers through enhanced unemployment benefits and direct payments, but also to provide a lifeline to both small and large businesses that have been impacted through largely no fault of their own. With the goal of aiding small and large businesses, in looking at the loan and grant stipulations, it appears Congress’ intentions had the individual consumer front and center. Stipulations such as maintaining minimum levels of pre-COVID-19 employment, capping executive compensation, disallowing the payment of dividends on common stock or buying back outstanding shares highlight Congress’ desire to ensure people get back on their feet, and stay on their feet. Before president Trump’s ink could even dry, politicians already started whispers of additional fiscal stimulus requirements; with some predicting the government spending reaching upwards of six trillion dollars, or roughly 27% of US GDP, to combat the fallout from the coronavirus. COVID-19. While typically more reactionary and measured in their approach, the Fed took aggressive proactive measures making their largest single rate cut of 0.50% (or 50 basis points) between scheduled Federal Open Market Committee (FOMC) meetings; the first time the Fed had taken such measures since the 2008 Financial Crisis. Less than two weeks later, again between scheduled meetings, the Fed dropped the rate on the Fed Funds effectively to zero. As the fear of the economic fallout escalated and oil continued to plummet, investors tried to sell nearly any asset containing risk; including any bond that wasn’t a treasury. While there were plenty wishing to sell, there were only a few looking to buy, creating an extraordinary dislocation across most bond categories. In order to bring back liquidity, the Fed again engaged in unprecedented measures by not only purchasing treasury securities and mortgage-backed securities, but for the first time ever, also stepping in to support municipal bonds, agency securities, and even corporate bonds through the purchase of Exchange Traded Funds – truly unprecedented. The Fed’s QE bond buying program has already seen the Fed’s balance sheet grow more than one trillion dollars; pushing their total balance sheet size above five trillion dollars. The Fed has failed to put a limit on the extent of their bond buying, leaving the amount available open-ended, but they have already purchased more in one day now than in an entire month during the Financial Crisis (80 billion).

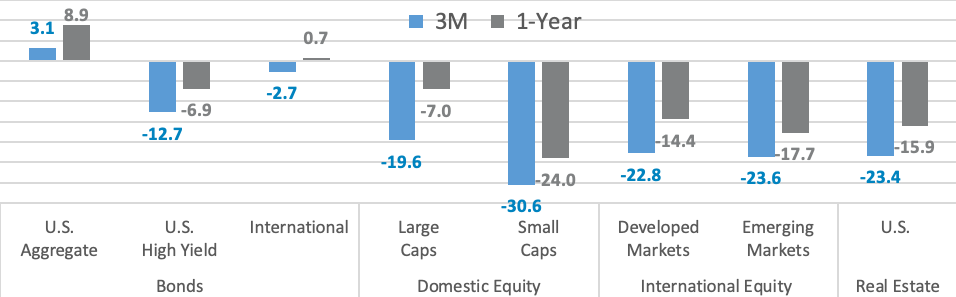

COVID-19. While typically more reactionary and measured in their approach, the Fed took aggressive proactive measures making their largest single rate cut of 0.50% (or 50 basis points) between scheduled Federal Open Market Committee (FOMC) meetings; the first time the Fed had taken such measures since the 2008 Financial Crisis. Less than two weeks later, again between scheduled meetings, the Fed dropped the rate on the Fed Funds effectively to zero. As the fear of the economic fallout escalated and oil continued to plummet, investors tried to sell nearly any asset containing risk; including any bond that wasn’t a treasury. While there were plenty wishing to sell, there were only a few looking to buy, creating an extraordinary dislocation across most bond categories. In order to bring back liquidity, the Fed again engaged in unprecedented measures by not only purchasing treasury securities and mortgage-backed securities, but for the first time ever, also stepping in to support municipal bonds, agency securities, and even corporate bonds through the purchase of Exchange Traded Funds – truly unprecedented. The Fed’s QE bond buying program has already seen the Fed’s balance sheet grow more than one trillion dollars; pushing their total balance sheet size above five trillion dollars. The Fed has failed to put a limit on the extent of their bond buying, leaving the amount available open-ended, but they have already purchased more in one day now than in an entire month during the Financial Crisis (80 billion). “We are confident that having Brian as part of the team will help propel us to new heights,” said Glenn Spencer, chief executive officer. “In our current growth mode, we will have increasing finance and data needs. Brian is the right leader to help us develop and manage financial systems and processes to operate in the future.”

“We are confident that having Brian as part of the team will help propel us to new heights,” said Glenn Spencer, chief executive officer. “In our current growth mode, we will have increasing finance and data needs. Brian is the right leader to help us develop and manage financial systems and processes to operate in the future.”